35+ what percent of mortgage to income

Apply Online Get Pre-Approved Today. See if you qualify.

Pipeline Magazine Summer 2019 By Acuma Issuu

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio.

. 2 To calculate your maximum monthly debt based on this ratio multiply your. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income. Web Front-end only includes your housing payment.

Web The 28 rule refers to your mortgage-to-income ratio. The principal interest taxes and insurance or PITI. Most of the land mass of the nation outside of large cities qualify for USDA.

Web Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Find all FHA loan requirements here.

Ad Are you eligible for low down payment. Find A Lender That Offers Great Service. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Web To calculate your front-end ratio add up your monthly housing expenses only divide that by your gross monthly income then multiply the result by 100. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web To illustrate if your monthly gross earnings are 9500 and net earnings are 8000 your monthly mortgage payment should be between 3325 9500 35 and.

Apply See If Youre Eligible for a Home Loan Backed by the US. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income. Web The 3545 model.

Web Factors that impact affordability. Maximum allowable income is 115 of local median income. Or 45 or less of your after-tax net income.

Choose The Loan That Suits You. That number is the max you should be. When it comes to calculating affordability your income debts and down payment are primary factors.

Try our mortgage calculator. Ad Dedicated to helping retirees maintain their financial well-being. Compare More Than Just Rates.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Get an idea of your estimated payments or loan possibilities. How much house you can afford is also.

Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest. Web When calculating your household expenses Sethi says to consider everything your mortgage will include. Compare More Than Just Rates.

Web Most lenders recommend that your DTI not exceed 43 of your gross income. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Ad Compare Best Mortgage Lenders 2023.

Ad Calculate Your Payment with 0 Down. Web Learn how to calculate what percent of your net income should go toward mortgage payments each month so you dont overspend. Get All The Info You Need To Choose a Mortgage Loan.

Were not including additional liabilities in estimating the. Top backend limit rises. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Find A Lender That Offers Great Service.

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

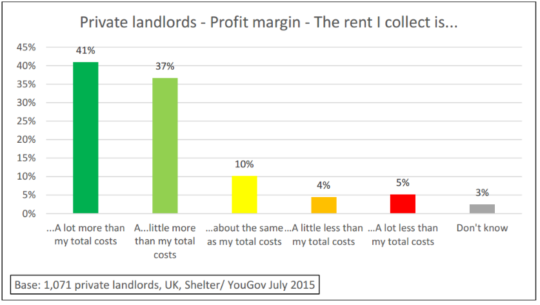

Debate Around Buy To Let Tax Changes Points To General Need For Extra Safeguards For Tenants Shelter

What Percentage Of Your Income To Spend On A Mortgage

Housing Affordability In Canada 2022 Re Max Report

What Percentage Of Your Income Should Go To Mortgage Chase

One Quarter Of Td Mortgages Now Have An Amortization Of 35 Years Mortgage Rates Mortgage Broker News In Canada

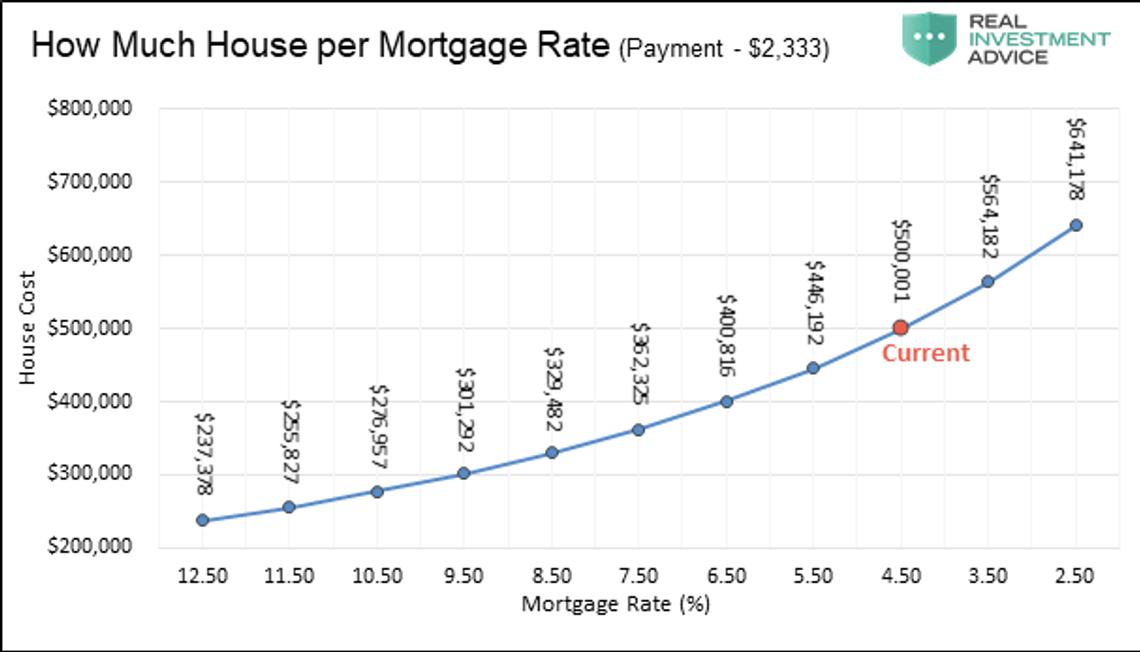

Interest Rates And Your Mortgage Maplewood South Orange Real Estate And Homes

How Much House Can You Afford Calculator Cnet Cnet

What Percentage Of Income Should Go To A Mortgage Bankrate

Social Security United States Wikipedia

Average Mortgage To Income Ratio For Different Income Quintiles Download Scientific Diagram

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

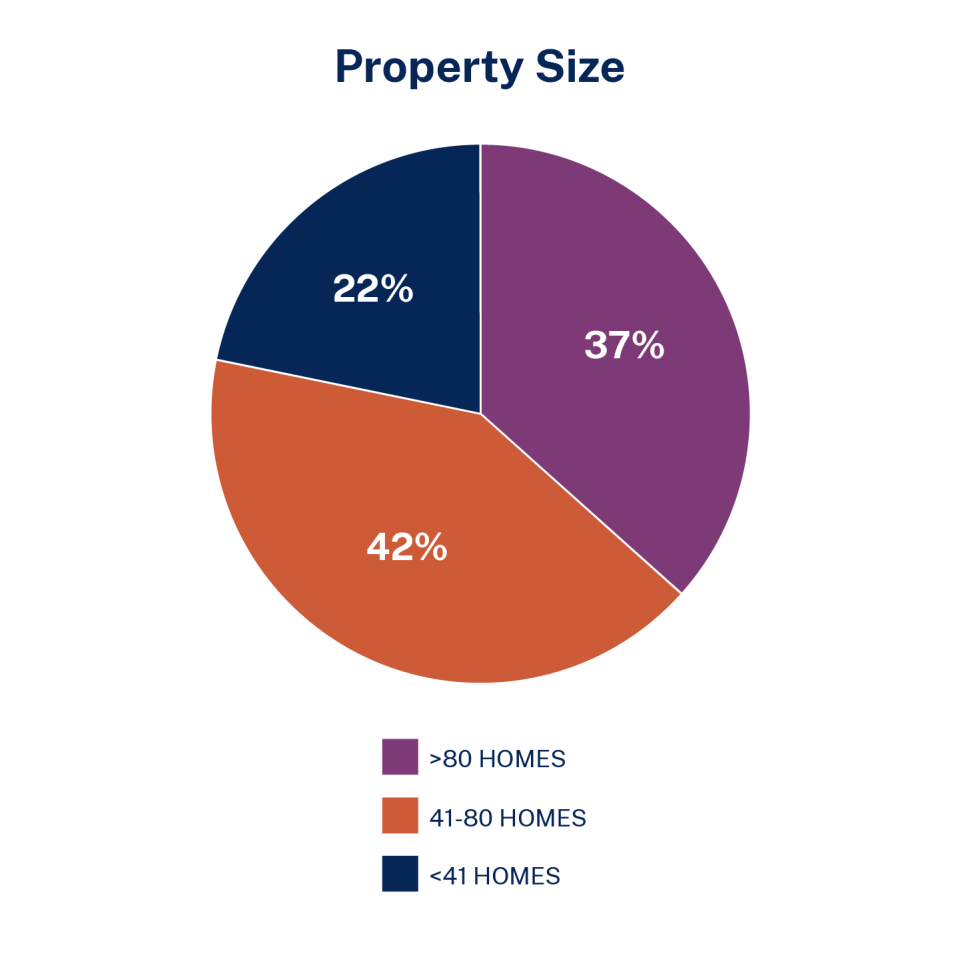

Low Income Housing Tax Credit Enterprise Community Partners

Interest Rates And Idaho S Housing Market Idaho Work

Is It Okay For Our Mortgage Payment To Be 35 Of Our Gross Income Youtube

What Percentage Of Your Income Should Your Mortgage Be

Myth Busters Dispelling Common Myths In Mortgage Banking Stratmor Group